I wanted to dedicate a special post to the new version of Bearbot. While I’ve already shared its history in a previous post, it really doesn’t capture the full extent of the effort I’ve poured into this update.

The latest version of Bearbot boasts a streamlined tech stack designed to cut down on tech debt, simplify the overall structure, and laser-focus on its core mission: raking in those sweet stock market gains 🤑.

Technologie

- Django (Basic, not DRF): A high-level Python web framework that simplifies the development of secure and scalable web applications. It includes built-in tools for routing, templates, and ORM for database interactions. Ideal for full-stack web apps without a heavy focus on APIs.

- Postgres: A powerful, open-source relational database management system known for its reliability, scalability, and advanced features like full-text search, JSON support, and transactions.

- Redis: An in-memory data store often used for caching, session storage, and real-time messaging. It provides fast read/write operations, making it perfect for performance optimization.

- Celery: A distributed task queue system for managing asynchronous tasks and scheduling. It’s commonly paired with Redis or RabbitMQ to handle background jobs like sending emails or processing data.

- Bootstrap 5: A popular front-end framework for designing responsive, mobile-first web pages. It includes pre-designed components, utilities, and customizable themes.

- Docker: A containerization platform that enables the packaging of applications and their dependencies into portable containers. It ensures consistent environments across development, testing, and production.

- Nginx: A high-performance web server and reverse proxy server. It efficiently handles HTTP requests, load balancing, and serving static files for web applications.

To streamline my deployments, I turned to Django Cookiecutter, and let me tell you—it’s been a game changer. It’s completely transformed how quickly I can get a production-ready Django app up and running.

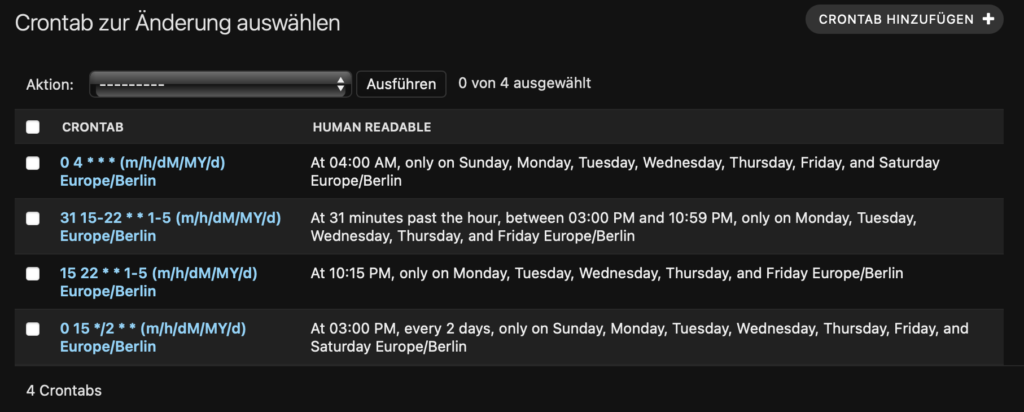

For periodic tasks, I’ve swapped out traditional Cron jobs in favor of Celery. The big win here? Celery lets me manage all asynchronous jobs directly from the Django Admin interface, making everything so much more efficient and centralized.

Sweet, right ?

Features

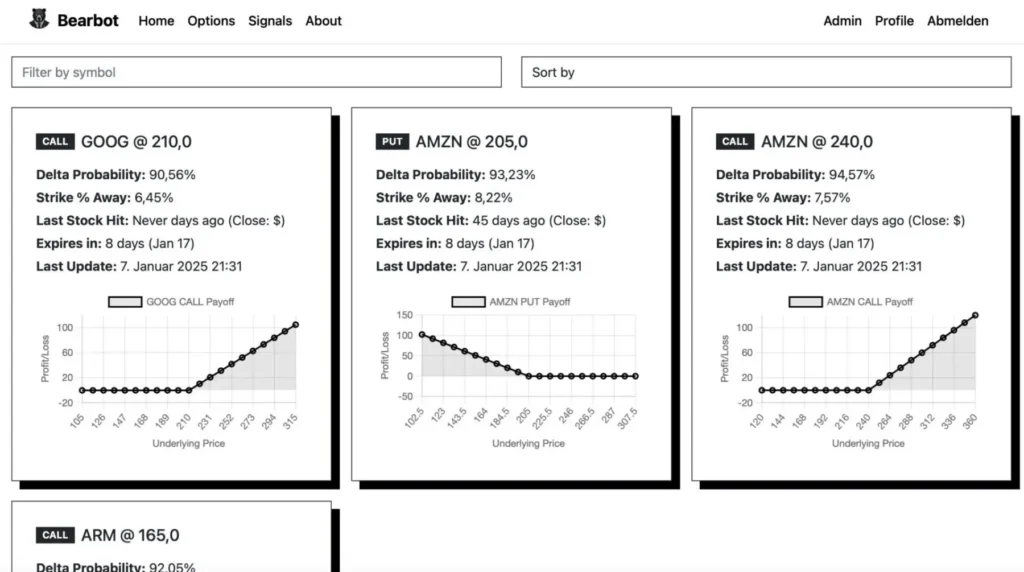

Signals

At its core, this is Bearbot’s most important feature—it tells you what to trade. To make it user-friendly, I added search and sort functionality on the front end. This is especially handy if you have a long list of signals, and it also improves the mobile experience. Oh, and did I mention? Bearbot is fully responsive by design.

I won’t dive into how these signals are calculated or the reasoning behind them—saving that for later.

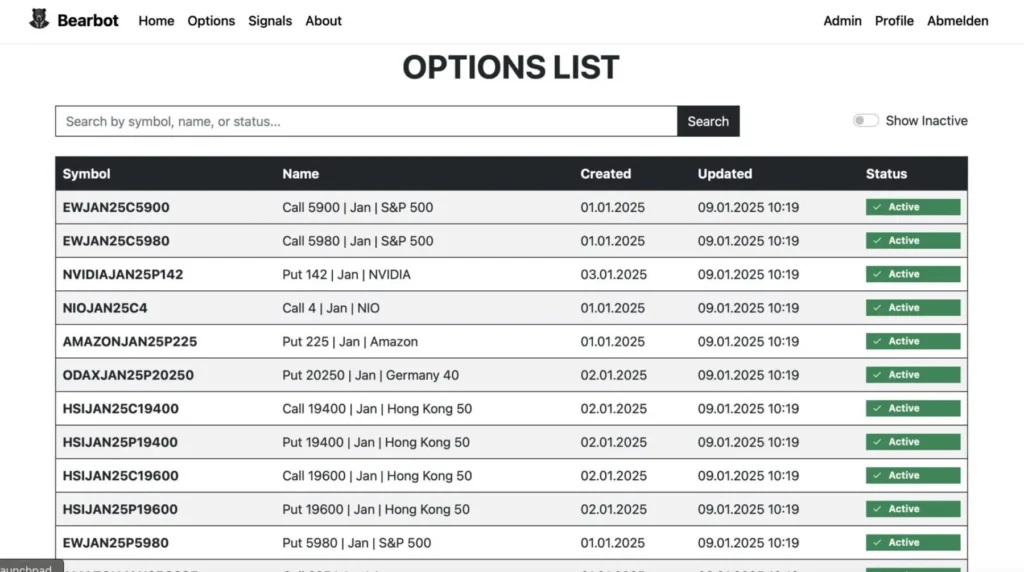

Available Options

While you’ll likely spend most of your time on the Signals page, the Options list is there to show what was considered for trading but didn’t make the cut.

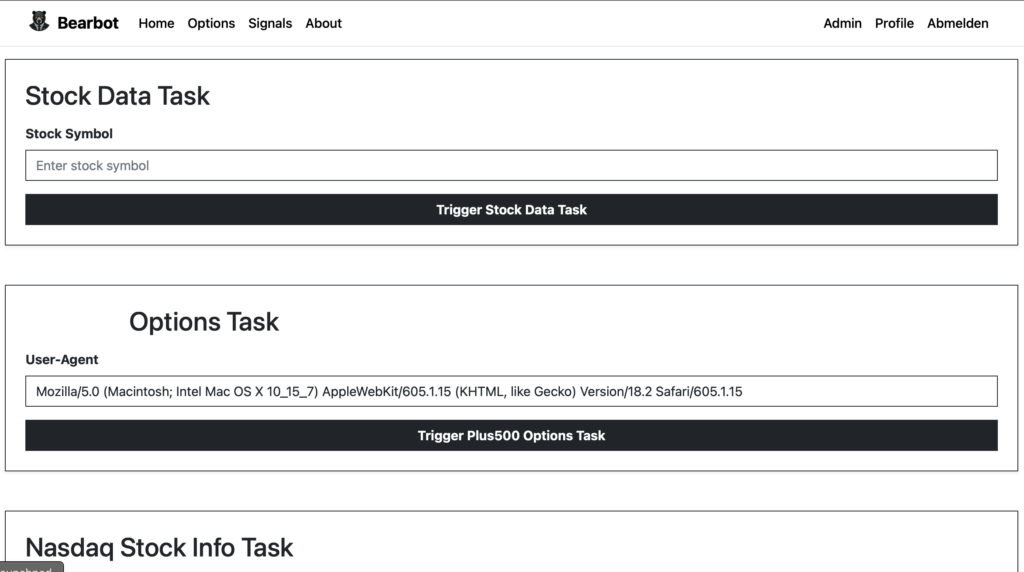

Data Task Handling

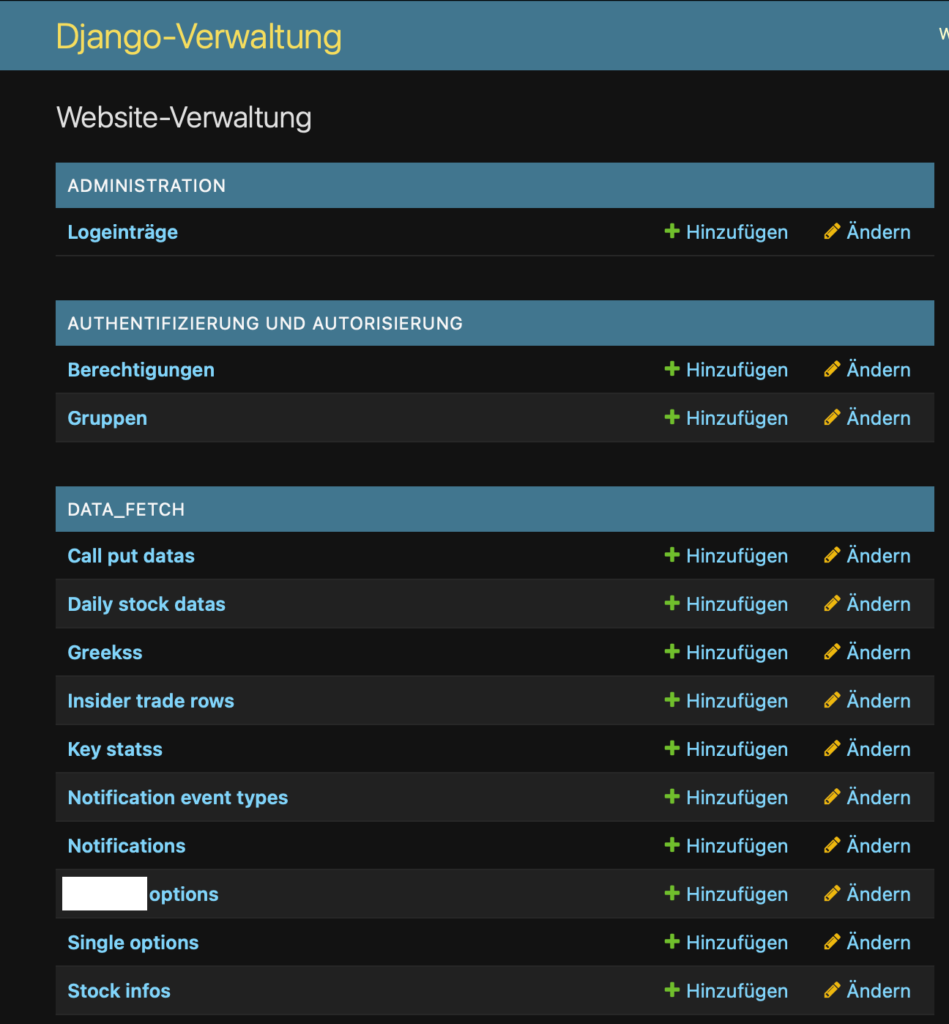

Although most tasks can be handled via the Django backend with scheduled triggers, I created a more fine-tuned control system for data fetching. For example, if fetching stock data fails for just AAPL, re-running the entire task would unnecessarily stress the server and APIs. With this feature, I can target specific data types, timeframes, and stocks.

User Management

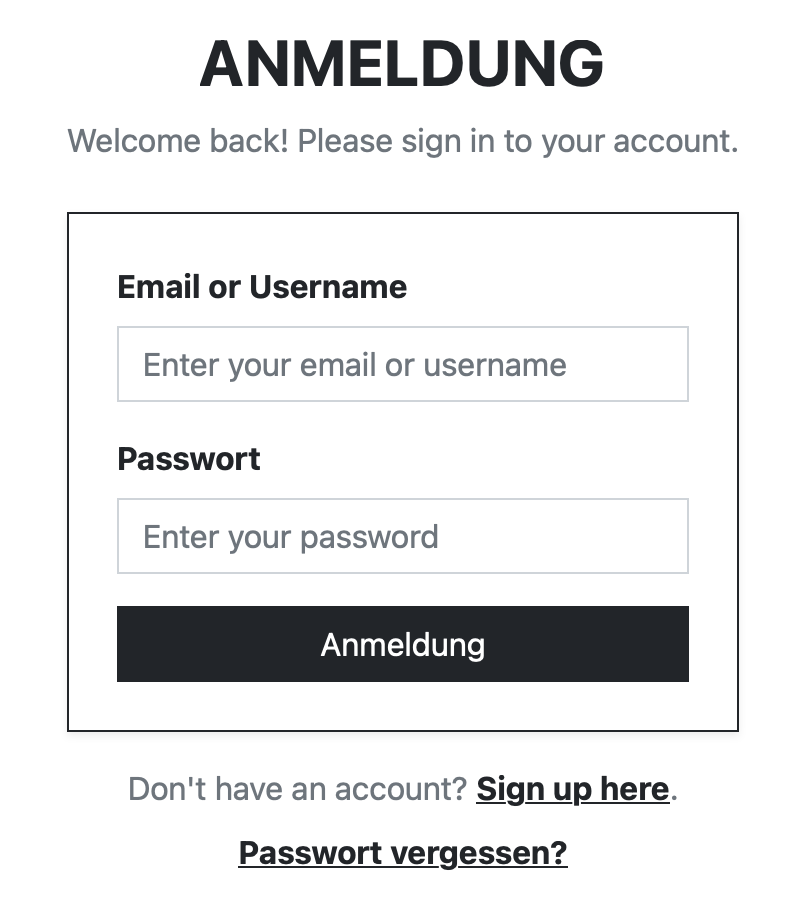

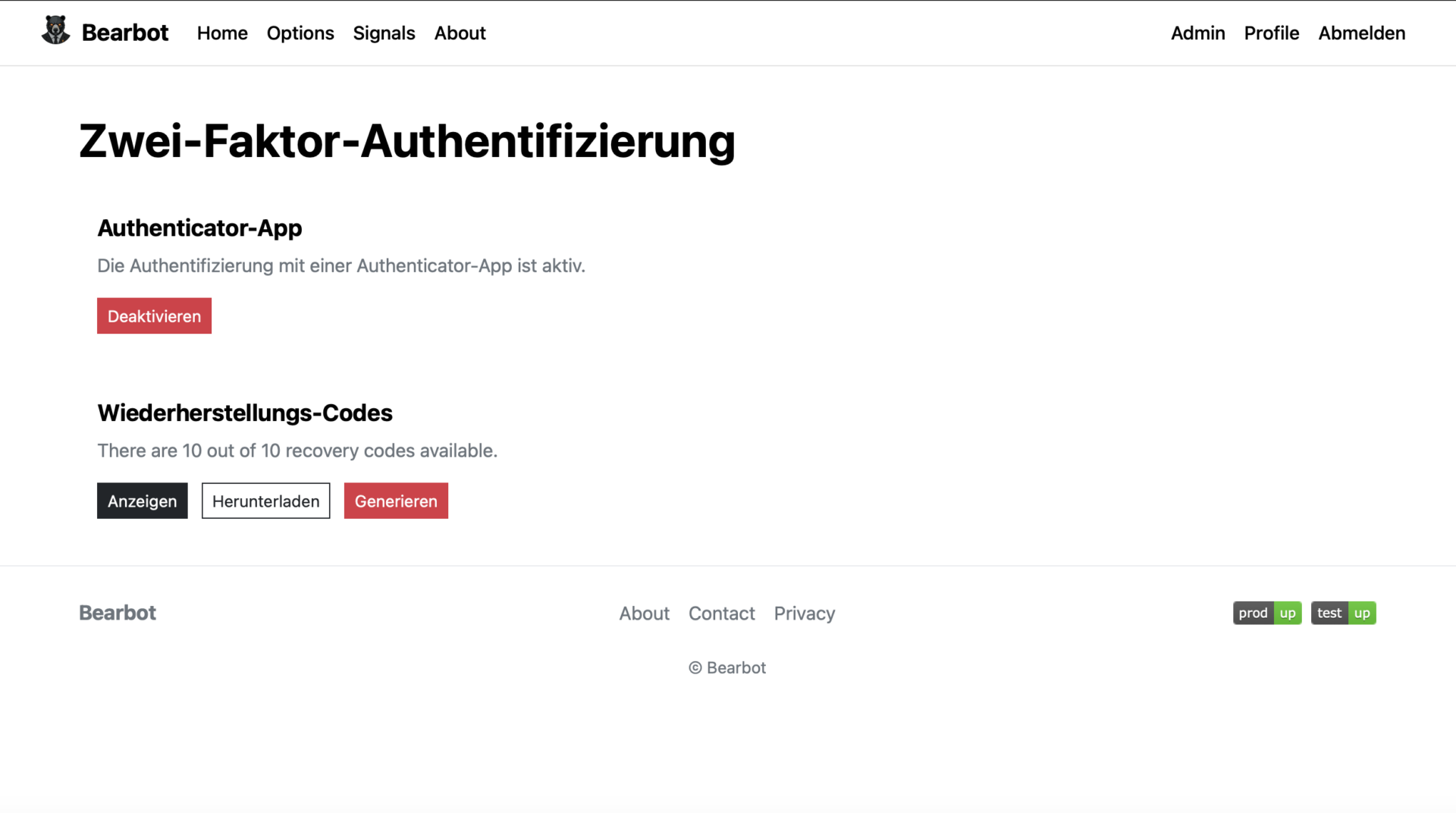

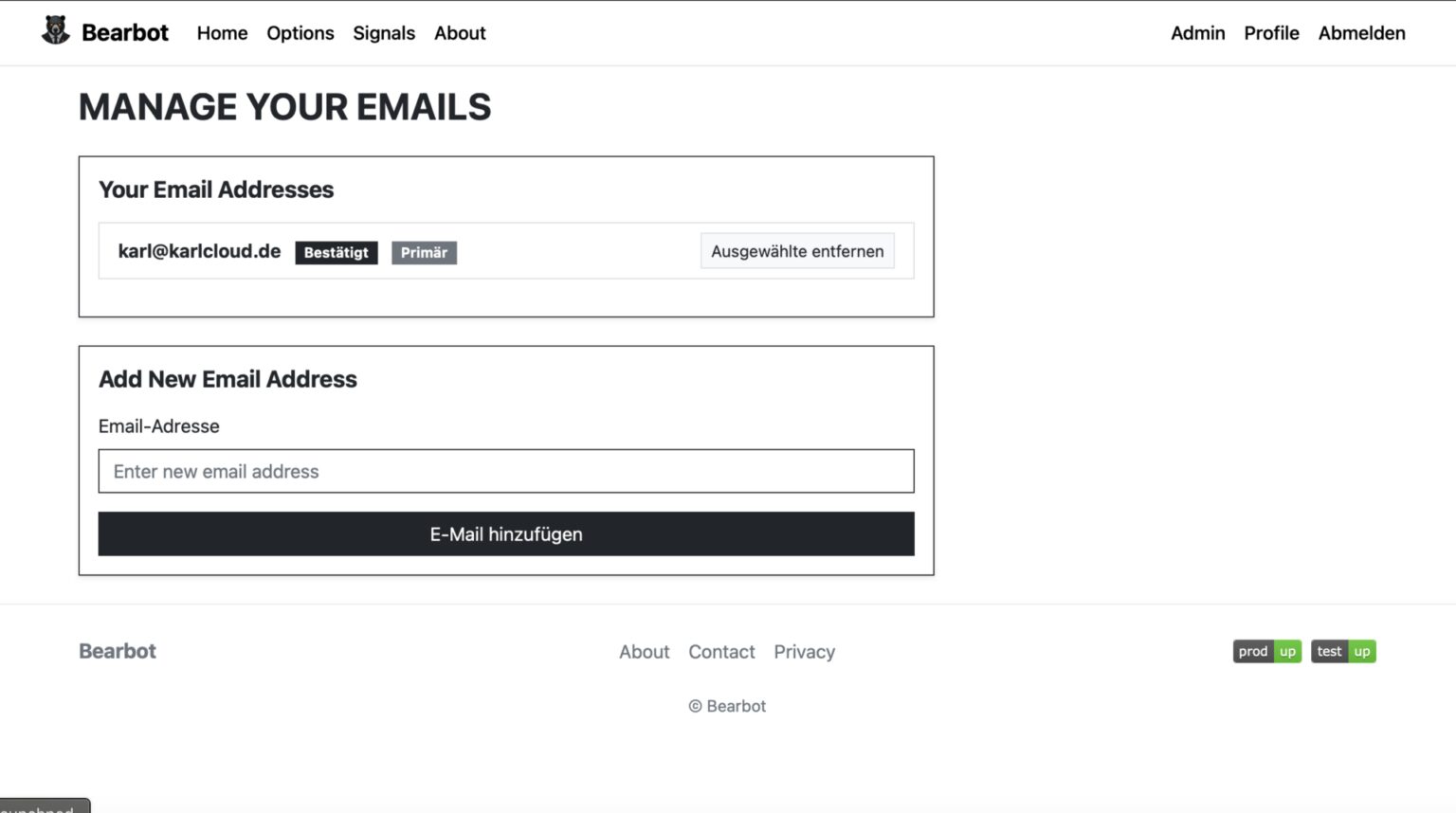

Bearbot offers complete user management powered by django-allauth, with clean and well-designed forms. It supports login, signup, password reset, profile updates, multifactor authentication, and even magic links for seamless access.

Datamanagement

Thanks to Django’s built-in admin interface, managing users, data, and other admin-level tasks is a breeze. It’s fully ready out of the box to handle just about anything you might need as an admin.

Keeping track of all the Jobs

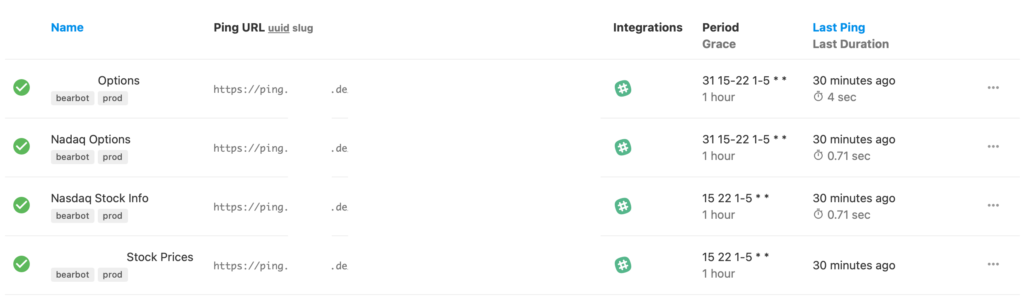

When it comes to monitoring cronjobs—whether they’re running in Node-RED, n8n, Celery, or good old-fashioned Cron—Healthchecks.io has always been my go-to solution.

If you’ve visited the footer of the bearbot.dev website, you might have noticed two neat SVG graphics:

Those are dynamically loaded from my self-hosted Healthchecks instance, giving a quick visual of job statuses. It’s simple, effective, and seamlessly integrated!

On my end it looks like this:

How the Signals work

Every trading strategy ever created has an ideal scenario—a “perfect world”—where all the stars align, and the strategy delivers its best results.

Take earnings-based trading as an example. The ideal situation here is when a company’s earnings surprise analysts with outstanding results. This effect is even stronger if the company was struggling before and suddenly outperforms expectations.

Now, you might be thinking, “How could I possibly predict earnings without insider information?” There are a lot of things you could consider that indicate positive earnings like:

- Launching hyped new products that dominate social media conversations.

- Announcing major partnerships.

- Posting a surge in job openings that signal strategic growth.

There are a lot of factors that support facts that a company is doing really good.

Let’s say you focus on one or two specific strategies. You spend considerable time researching these strategies and identifying supporting factors. Essentially, you create a “perfect world” for those scenarios.

Bearbot then uses statistics to calculate how closely a trade aligns with this perfect world. It scans a range of stocks and options, simulating and comparing them against the ideal scenario. Anything scoring above a 96% match gets selected. On average, this yields about 4-5 trades per month, and each trade typically delivers a 60-80% profit.

Sounds like a dream, right? Well, here’s the catch: it’s not foolproof. There’s no free lunch on Wall Street, and certainly no guaranteed money.

The remaining 4% of trades that don’t align perfectly? They can result in complete losses—not just the position, but potentially your entire portfolio. Bearbot operates with tight risk tolerance, riding trades until the margin call. I’ve experienced this firsthand on a META trade. The day after opening the position, news of a data breach fine broke, causing the stock to plummet. I got wiped out because I didn’t have enough cash to cover the margin requirements. Ironically, Bearbot’s calculations were right—had I been able to hold through the temporary loss, I would’ve turned a profit. (Needless to say, I’ve since implemented much better risk management. You live, you learn.)

If someone offers or sells you a foolproof trading strategy, it’s a scam. If their strategy truly worked, they’d keep it secret and wouldn’t share it with you. Certainly not for 100€ in some chat group.

I’m not sharing Bearbot’s strategy either—and I have no plans to sell or disclose its inner workings. I built Bearbot purely for myself and a few close friends. The website offers no guidance on using the signals or where to trade, and I won’t answer questions about it.

Bearbot is my personal project—a fun way to explore Django while experimenting with trading strategies 😁.